*READ MORE ABOUT Amazon BLACK HAT: War is On: How to Fight Unfair Competition on Amazon * Black Hat for Amazon FBA Sellers explained.

What are the secret weapons behind the success of Chinese e-commerce companies on Amazon, such as Sunvalley, Aukey, and Anker? How could the made-in-China reach such a great success in today’s most competitive online marketplace? Is it just a matter of lower price? Is it because Chinese sellers are using some kind of black-hat technology or trick? Or maybe, it is the made-in-China that is actually changing? If you are asking yourself these questions and don’t know where to find answers, trust me, you’re not the only one. As a former expat who has lived in Shenzhen, the Chinese capital of Tech & Electronic innovation for several years since 2014 working with major Amazon sellers such as Sunvalley, ATC, Aukey, etc., and then since 2017 as founder of Growth Hack Consulting HK, a Digital Marketing Agency that is helping a lot of Chinese and Western Sellers to make a better business on Amazon, I have had these questions asked a lot of times. Not only I am going to share with you my direct experience, pointing out the most important elements that differentiate Chinese companies from European & American companies when it comes to making business online, but I will add more comments and secrets told by other western professionals who have been working in China with Chinese Amazon sellers – the Insiders.

Topic List

1. Constant Research and Competitor-Analysis 2. Product Selection Based on Performance Rather than Actual Branding 3. Highly Practical Culture in China 4. Flexible Structure and Internal Organisation 5. Very Early Entrepreneurship Mindset 6. Increasing (or Decreasing?) Presence of Skilled Foreigners in China 7. Supply and Generally Easier Access to Key-Resources 8. Black Hat Technology and Practices 9. “Creative” Product Launch Strategies 10. Extremely Competitive Culture 11. Constant Self-Improvement and Study 12. Conclusions Next Research – “War is On: How to Fight Unfair Competition on Amazon”1. Constant Research and Competitor-Analysis

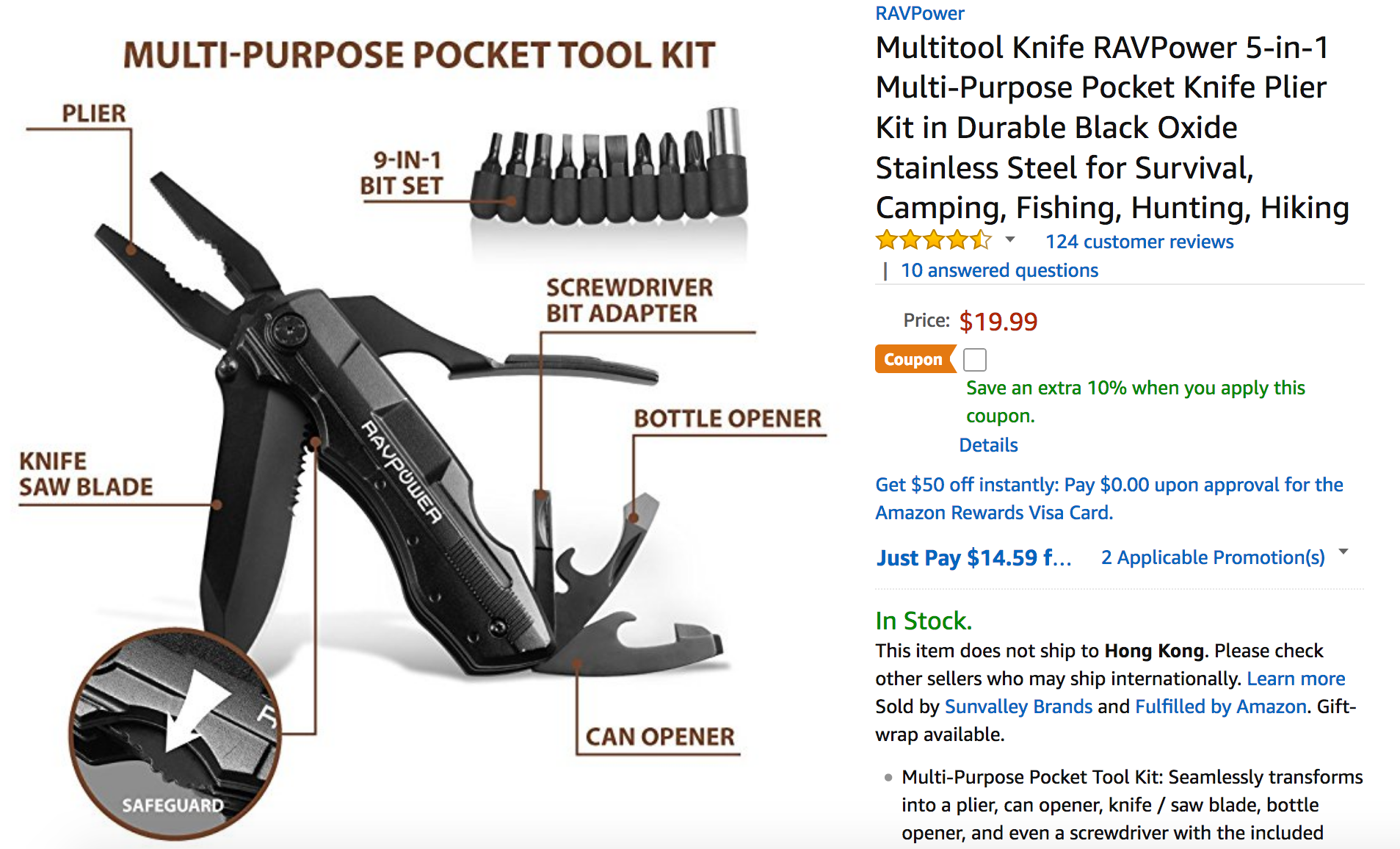

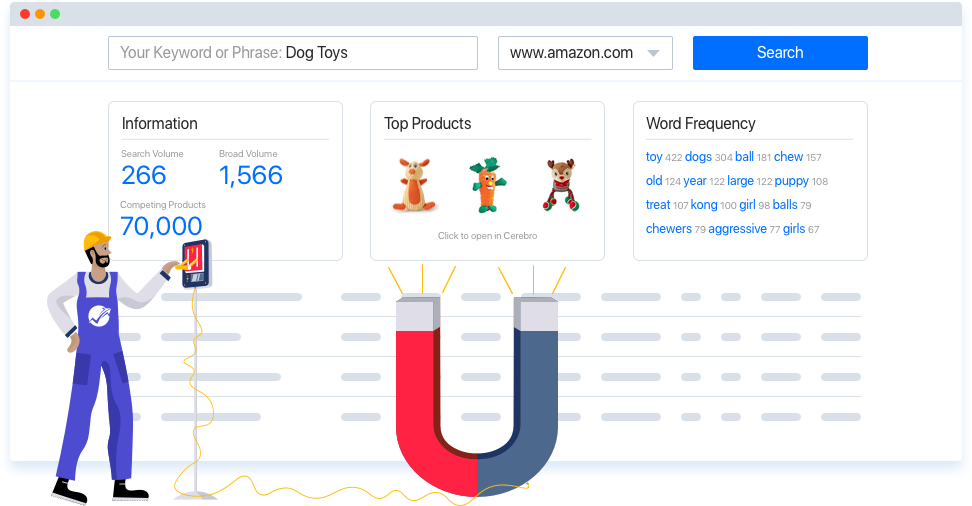

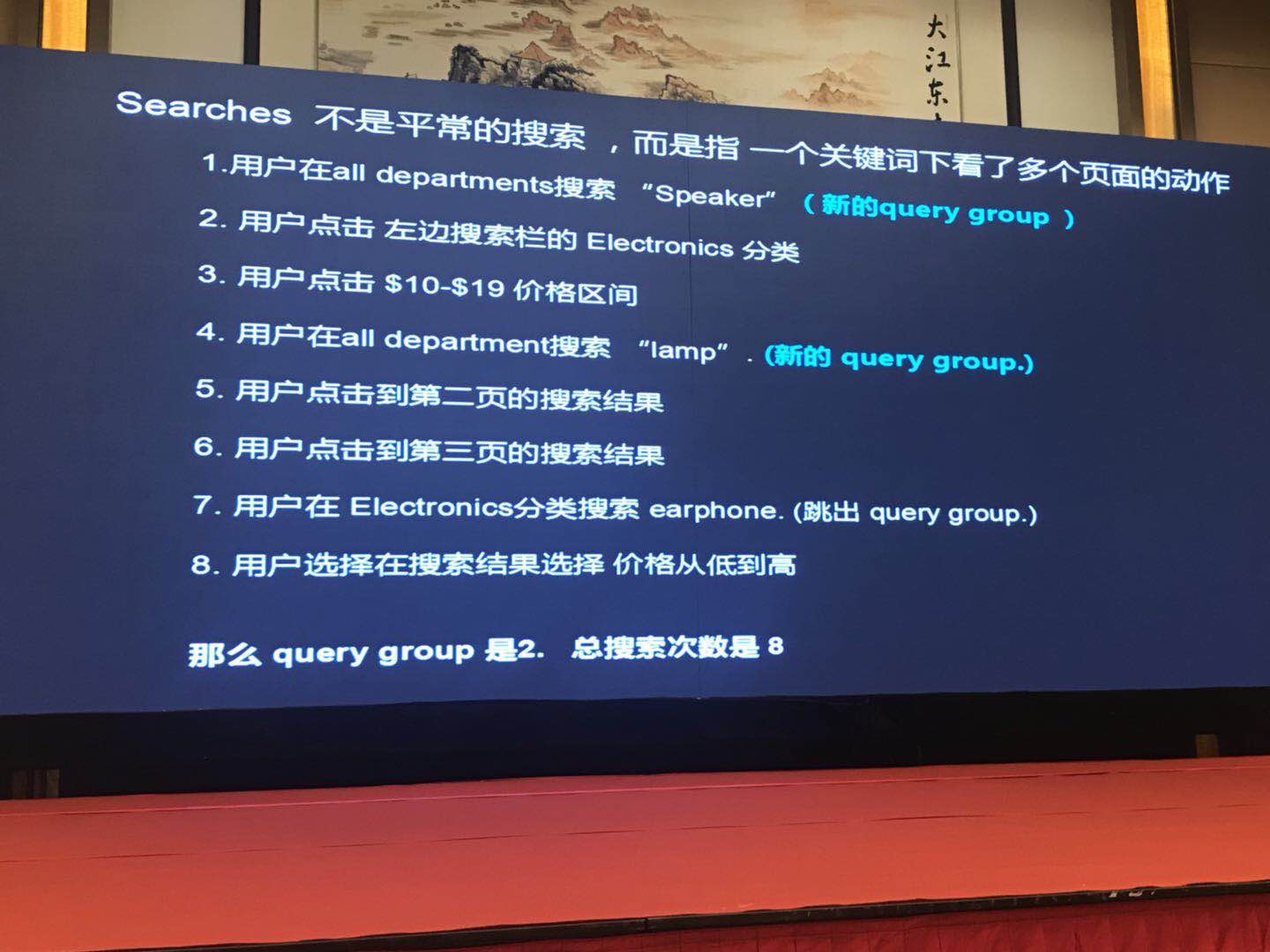

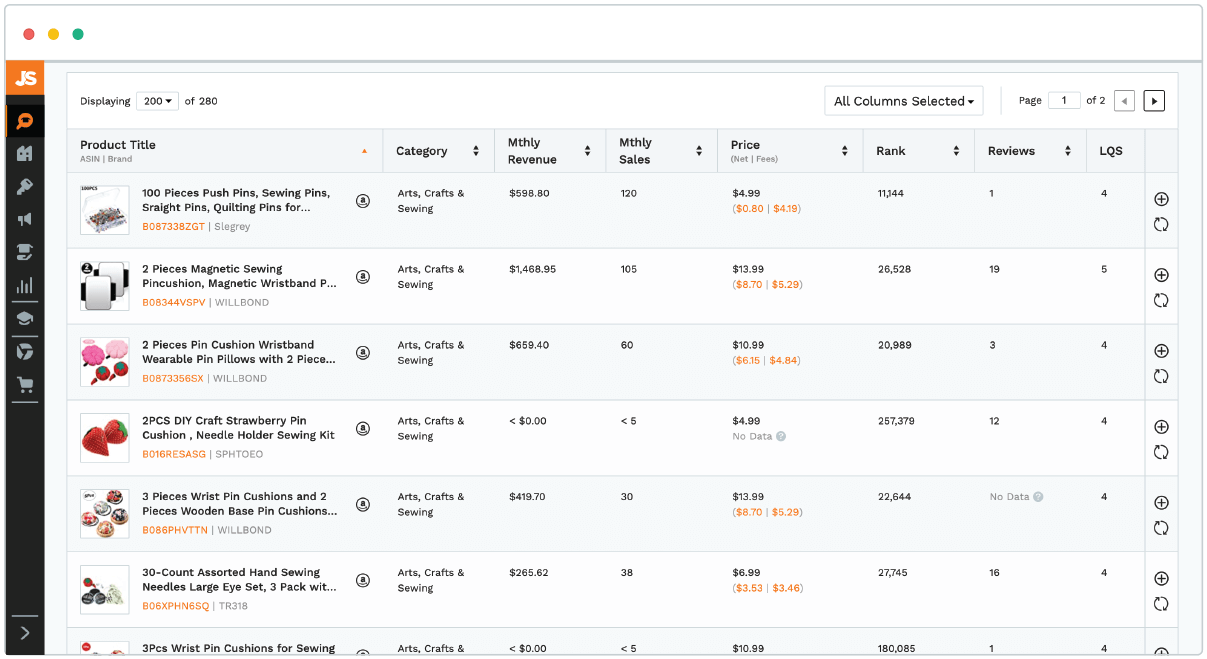

The average sales manager in a Chinese e-commerce company spends a lot of time on product research: pricing, competitors search, keywords research for listing optimization, with a special attention (some would say “obsession”) to their competitors. The research has got such a heavy weight on the daily tasks of the account managers, that their entire working day can be summarized in a huge Excel spreadsheet. The research is driven by a true obsession with the top-performing competitors. I remember when I was working at RAVPower – top seller on Amazon for Powerbanks -, that the term of comparison was always how good Anker was ranking on this or on that particular product category. Saying it with Noah Herschman with whom I had the pleasure to work at Marketplace Ignition Asia:

The research is driven by a true obsession with the top-performing competitors. I remember when I was working at RAVPower – top seller on Amazon for Powerbanks -, that the term of comparison was always how good Anker was ranking on this or on that particular product category. Saying it with Noah Herschman with whom I had the pleasure to work at Marketplace Ignition Asia:

“The Chinese in general are competitor-obsessed. In fact, if you want to get a Chinese company’s attention, just tell them that you can help them best a competitor and they’re all ears. They at this point have a lot of tools including Seller Labs, Merchant Words, Amazon Shark, etc. that deliver a lot of competitor data. […] The general reaction is to compete in a “red ocean” paradigm, rather than a blue ocean one. If a competitor’s product is a dollar cheaper, then they will lower theirs by $2. If the competitor adds a new feature, they will match that feature straight away. Perhaps the more effective methodology would be to think out of the box and create a whole new product or at least a new feature set. This rarely happens with Chinese manufacturers who sell on Amazon today. However, this will probably be a shor-term phenomenon as China’s technology industry is growing more and more robust and will soon rival creative hotbeds such as Silicon Valley and Israel’s Silicon Wadi.”

According to John Rood, co-founder of Somos Agency in Shenzhen, the whole research and competitor-analysis job of the sales manager depends on the size of the organization. For small sellers (less than 30 people) this is a generally done by individual sales managers, a separated country store that they are managing at least for 2-3 hours/day. For the big sellers, the research has got a full time position for at least 2-3 people per country. Back to top2. Product Selection Based on Performance Rather than Actual Branding

“This research definitely effects the final product selection” continues John,” otherwise they would stop paying their staff to do it. As soon as their research shows the slightest bit of promise, management will approve a budget to try a test round and see how things go. They will find whichever product category has the least competition, make a plan to buy inventory, ship and start selling, etc. They will then pitch this to the higher ups, who will either approve or deny the funding to try it.” The main question here is: did the big sellers like Anker, Sunvalley, Aukey start getting serious on selling power banks simply because it was one of the products that sold best, between the random thousands of products thrown at Amazon.com while waiting for the sales to show up at some point? Or did they have an actual plan and strategy to sell power banks back to 4/5 years ago?“At that time (I had just started running the Amazon CE business)” – continues Noah Herschman, “Amazon was having a hard time getting name brands, so they would allow any brand to sell on the site – and they had a lot of customers who wanted to buy from Amazon, but were unable to find name brand products. And since then Amazon actually become more important to the customer than the brands themselves. Amazon’s great content and review system was effective in overcoming a number of customer objections to buying off-branded products. What’s really scary is now brands can become global just through the Amazon platform alone. The table below shows that Anker has become a top-Chinese brand just through selling on Amazon”:

We will come back to these big advantages later, on the paragraph about the easier access to several resources for Chinese companies: in today’s extra-competitive and extra-fast-paced environment, speed is everything.

If one of the hundreds of products that they release gets popular, there is no reason for them to not to source variations and other models. Not only does success in a product category means that that product is in demand if a company stops at just one product, there are plenty of copy-cat competitors who are waiting in the wings ready with their own product. You could actually argue that when a Chinese company floods the market with variations of a product, it is done in an effort to curb would-be competition or stop the competitors from taking their sales. As you can see, being a sales manager here implies a lot of strategic thinking.

Back to top

We will come back to these big advantages later, on the paragraph about the easier access to several resources for Chinese companies: in today’s extra-competitive and extra-fast-paced environment, speed is everything.

If one of the hundreds of products that they release gets popular, there is no reason for them to not to source variations and other models. Not only does success in a product category means that that product is in demand if a company stops at just one product, there are plenty of copy-cat competitors who are waiting in the wings ready with their own product. You could actually argue that when a Chinese company floods the market with variations of a product, it is done in an effort to curb would-be competition or stop the competitors from taking their sales. As you can see, being a sales manager here implies a lot of strategic thinking.

Back to top

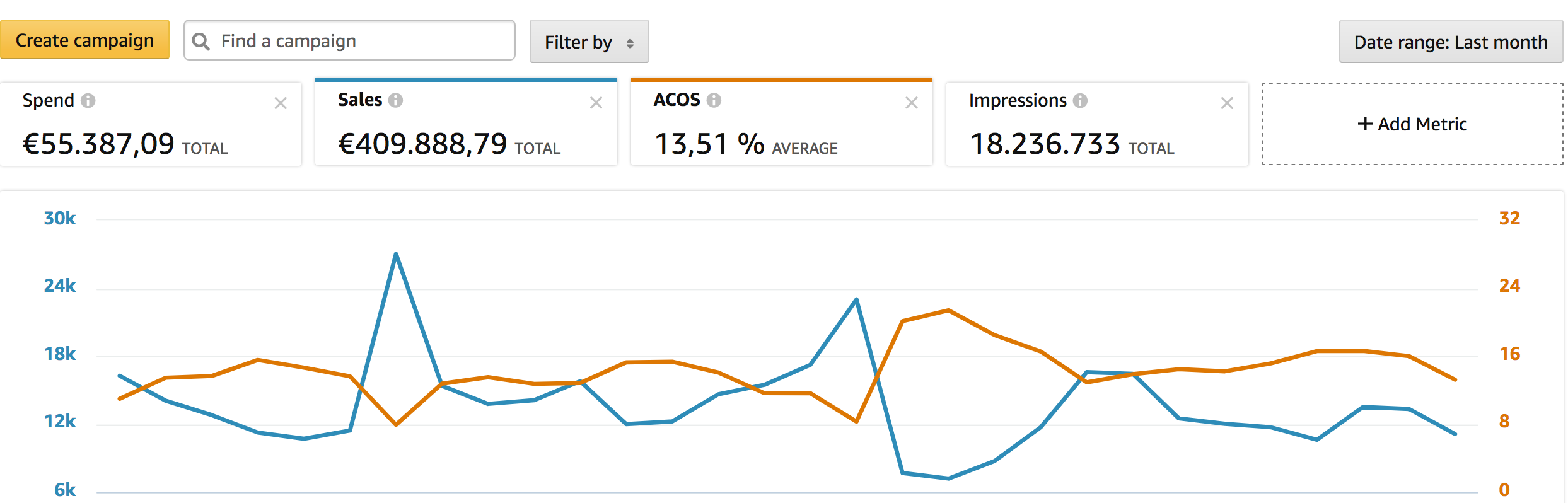

[mkd_button size=”” type=”gradient” hover_type=”gradient” target=”_self” icon_pack=”” font_weight=”” text=”How did I make 409,888€ in 30 days with 13% ACoS?!” link=”https://wearegrowthhack.com/contact-us/”]

[mkd_button size=”” type=”gradient” hover_type=”gradient” target=”_self” icon_pack=”” font_weight=”” text=”How did I make 409,888€ in 30 days with 13% ACoS?!” link=”https://wearegrowthhack.com/contact-us/”]

3. Highly Practical Culture in China

Since the very beginning of my professional life in China, I’ve realized that the working culture is a lot different than the one in the West. The Culture that dominates here is more of a “trial and error approach”, influenced by the very strong practical sense of the Chinese entrepreneurs and employees; said in other words: a strong get-shit-done approach, a lot different from the plan > strategy > analysis > research > approval of Western companies, that just by looking at it makes you realize how slow it is in comparison. This approach is generally subject to a lot of mistakes and re-thinking along the way, but it makes everything much faster. In today’s online business with this very high competition, speed can be a big advantage to a flawless quality. By the time a Western company has researched the market, worked on a sales strategy, and made a marketing plan to support an upcoming product, a Chinese company will have either moved onto the next product or will be launching the follow up product to their original one. This means they can constantly flood the market with new products in a way that Western counterparts cannot. Ultimately, this doesn’t mean that a Chinese company will always be successful, and if they are, they will probably be successful now, not in months-years time. Anyway they would probably not care much of the long-term investment, or not as much as a US-EU company would. Besides if it’s not them, it will be their competitor because no one is waiting around.

This topic is strictly connected with the use of black-hat technology and strategies (mainly by small-medium sellers), that we will discuss later on.

Zack Franklin, a former employee at Valuelink adds:

Ultimately, this doesn’t mean that a Chinese company will always be successful, and if they are, they will probably be successful now, not in months-years time. Anyway they would probably not care much of the long-term investment, or not as much as a US-EU company would. Besides if it’s not them, it will be their competitor because no one is waiting around.

This topic is strictly connected with the use of black-hat technology and strategies (mainly by small-medium sellers), that we will discuss later on.

Zack Franklin, a former employee at Valuelink adds:

“This is absolutely a core divide between the west and the east. I met a seller a few weeks ago, her name was Apple and her journey to sell on Amazon was amazing. She went to an Amazon meetup, decided it was something she wanted to do, called up her friend who owns a factory, placed an order that day, and shipped her first order into Amazon a few days later. Within 2 weeks she was already selling on Amazon. Compare that to a western seller that wants to get started – they typically spend 6 months or more learning from podcasts and blogs before they even get started! In China, speed is everything. […]Sometimes, this ends up as a massive waste of resources, but it’s much better than procrastination, and often the ideas can pivot into something worthwhile. Western companies have no idea what they’re dealing with. Chinese companies learn something, apply it that instant”.

Zack continues by showcasing the example of Mobike-Ofo-Bluegogo bikesharing business: it started Shenzhen, and within a matter of months the companies went through price wars, massive competition, rapid expansion, and now even mergers and acquisitions, within a matter of months: “the entire business cycle would have taken years to play out in the west. When Chinese companies go abroad, they realize they’re well equipped because they have to deal with such fierce competition within China”. Bikesharing might not be the best example of a business model that is sustainable in the long term, but has been a great idea indeed: it grew super-fast, but something went out of control. It is also another good example of how the Chinese practical culture can be a good or bad element, most of the time it will be bad if combined with arrogance of throwing money in any short-term business, just for the sake of trying to getting rich fast: the bike-sharing business is facing a hard time right now between the users worried of not getting the deposit back and the main players going bankrupt.

Finding it very hard to grow your Amazon sales in 2020?

4. Flexible Structure and Internal Organisation

One more thing that influences the operational speed within Chinese companies is definitely their flexible structure and less strict internal regulations when it comes to HR (it is often discussed about the workers’ rights compared to the western companies). When I had just joined Sunvalley for a few months, the company was following a horizontal organization of the human resources (division per countries/marketplaces), that had been changed later to a vertical organization (division per product lines and brands) as the company grew bigger and grew with different needs. I remember receiving one email on a Tuesday afternoon at 5:30pm with the communication of new seats and literally changing my desk on a Wednesday morning. This, would be just utopia – or nightmare – in the West.

This, would be just utopia – or nightmare – in the West.

John Rood continues while talking about the internal division “one person is typically in charge of each store; for example, Sally will manage the US Amazon store and James will manage the Spain Amazon store. […]The requirements are really different for each company. In big companies, several people will assume responsibility for each Amazon store. Some will handle keyword research, some will focus on just writing product listings, etc. It all depends on the size of the company. As a general rule, bigger companies will break down employee roles in a more granular manner”.

The organization of the jobs can be even more detailed as the company grows bigger and adds more product lines, until reaching a division by product function/features – Bluetooth, LED, Power Banks, etc. Within a team, one person will be in charge of a selection of products (regardless of brand), however, this person will typically only focus on one region. The team members will report to the team leader who reports to the sales manager, who oversees each of the brands. This sales manager is a singular figure who reports to upper management. Back to top5. Very Early Entrepreneurship Mindset

One more element that increases the differences between China and the West, is the incredibly early entrepreneurship culture in China, if compared to the mindset that prevails among young men and women in the USA and in the EU. It is absolutely normal for many junior sales manager to acquire valuable experience in the most appealing e-commerce companies and start up their own store on Amazon within 2 or 3 years only. This is also why, today a well established Chinese company is as appealing as a Western company, or even better in the eyes of the fresh graduated students. In a big Chinese company there is much more to learn, and less to worry about for leaving only after a few months-years time (yes, turnover is very high in China). Add to this, the insanely large quantity of available equity investment (both from private and public sources), that makes it even easier for a spinoff to survive and potentially be successful in the market. The creation of a spinoff business actually starts to happen while employees are still employed at their original organization: they will leave the company once their own side business becomes more profitable. There are so many things that can be sold and there are dozens of markets, so a former employee (or a few working together) does little to harm a major brand. Employees in the system learn very quickly that they cannot compete against a bigger organization due to the scale of their operations and to the lower funds. Smaller seller teams that operate their own stores, try to do so in smaller niches – making the subcategories more and more crowded. They also pray that a big company doesn’t enter their niche as they cannot match them on price or their ability to drive customers to their listing. And as we said earlier in this post, the extremely practical culture is constantly pushing for “innovative” ideas, that might just be an innovative way to sell exactly the same product, under a different name. Better trying to get rich and fail than constantly be working for somebody else, right?

It could work, but it could also not work. I have seen a few businesses come out of the side and become the main business for some of my former colleagues, only to become again a side business and to eventually be dropped and forgotten.

And as we said earlier in this post, the extremely practical culture is constantly pushing for “innovative” ideas, that might just be an innovative way to sell exactly the same product, under a different name. Better trying to get rich and fail than constantly be working for somebody else, right?

It could work, but it could also not work. I have seen a few businesses come out of the side and become the main business for some of my former colleagues, only to become again a side business and to eventually be dropped and forgotten.

Noah Herschman explains this practice on a deeper level: “The issue that I see with Chinese companies and employment – especially in Southern China – is that the bosses expect the majority of their employees will learn the secrets and best practices of the company and leave to start their own Amazon Seller company. This is why companies are very careful in what information they share with their employees, and also refuse to pay employees a very high wage – because they feel that there is no incentive to try and keep employees since it is an eventuality that they will leave and compete. However, the most successful sellers I have seen are ones that have a bit more of Western approach: they trust their top managers and incentivize them either through profit sharing and/or stock ownership.” He adds later that “there is a huge value to having an early start on Amazon because search and sales history builds up over time so the longer the product is listed on Amazon, the better chances it has to rise up in search ranking. So it is better to try and stay with a company for a longer period of time because – unless you have some brand new category to compete in – it is hard to start at the bottom of competitive categories; you usually lose money for quite some time.”

6. Increasing (or Decreasing?) Presence of Skilled Foreigners in China

In the past 5 years, cities like Shenzhen, Hangzhou, Chengdu, Guangzhou and others that were almost unknown to the West compared to Beijing and Shanghai, became very appealing for skilled expats, offering competitive salaries while offering constantly improving living conditions and super efficient infrastructures: Shenzhen is right after Shanghai in the Chinese average salaries list, while the average cost of living is definitely lower. Skilled foreigners would help Chinese companies with all the jobs that non-native workers cannot perform best, such as content creation, marketing, social media and in the higher levels also with strategy and relationships with KOLs.“This is something that should keep American sellers up at night.” says Zack Franklin, “Chinese sellers have every advantage – from cheaper supply, better relationships, a huge community, less to pay in taxes, venture capital, but now they can also hire skilled foreigners to manage marketing.”

Unfortunately, still some “Chinese companies have very little idea how to attract and keep quality foreign talent, and cultural differences aren’t making it any easier. Many large sellers we’ve talked to in the last 6 months have proudly stated: Oh yes, we are in the process of hiring our own in-house team; although we have come back many months later to find that the situation has not changed. This is probably due to the fact that a lot of these companies are located far-out areas of Shenzhen like Longhua, Bantian, Longgang and Bao’an, where quality international talent are unlikely to relocate.” continues John Rood. “Although most foreigners were previously chosen based on their native language, the requirements for international talent have definitely increased dramatically everywhere. You can’t get by in marketing just being a native English speaker anymore. Being a native English speaker doesn’t make you a great copywriter.”

And Chinese companies are realizing this. Four years ago it was enough to speak the language to be hired as marketing manager for a specific country in a Chinese company. My former colleague in charge of PR and Marketing for Italy at Sunvalley had never done a similar job before. This would pretty much not happen anymore, at least not in the case of major Amazon sellers as Sunvalley is now. So on the one side we see the foreigners working in China as in a unique, expensive and very flexible position given their English/other languages ability and skills so there is no one set rule for them. On the other side, there is a general realization among expats that they will never make it to an upper management/directorial role in the bigger companies. Some main e-commerce sellers would rather give a high management position to a Chinese national, to a returnee from overseas or to an American Born Chinese. However for other companies, especially smaller ones, expats are as important as hardly affordable e.g. they can help set up operations in other countries, provide professionalism to all communications with customers/press.

“Chinese companies have less and less use for expats. Firstly, there is a real sense of Chinese nationalist pride – so if there is a position that can be filled either by a Chinese national or an expat, the position almost always goes to the Chinese national. I remember that head hunters used to contact me for positions that I was eminently qualified for – and they would say: You’re perfect for the job. Um… Do you know any Chinese candidates you could recommend? The recent advent of the Chinese Points system is a testament to this. China has always had somewhat of a merit-based immigration system, but the point system has cemented it. There are three tiers: * Grade A – This grade applies mainly to foreign high-end talents in specific industries as well as in higher education. Grade A expats are supported by the government to stay and be successful in China * Grade B – This category concerns most of the professionals, which are currently holding a Chinese work permit. Grade B expats are controlled by the government so that the number does not increase too much * Grade C – This category applies to all, who do not qualify for either Grade A or B. Grade C expats will probably have a harder and harder time getting their visas renewed.

Although the specific criteria will be decided by local governments, at least six criteria will be important: 1. Chinese language proficiency 2. University Degree from top international or Chinese university 3. Age 4. Salary 5. Work experience 6. Location in China (Tier 3 cities will get higher points than a Tier 1 Megapolis)

So here’s the hard question: If you do not have a lot of weight in all or most of these, what value can you bring to a Chinese seller? Even though you may be an English speaker, most of the Chinese sellers’ content style is more “Keyword-ese” than English. They are usually very good at optimizing titles and descriptions to maximize search results over a number of critical keywords. That does not require native English. Also Chinese companies are more and more interested in hiring “returnees” – Chinese nationals who went to university or have worked abroad.

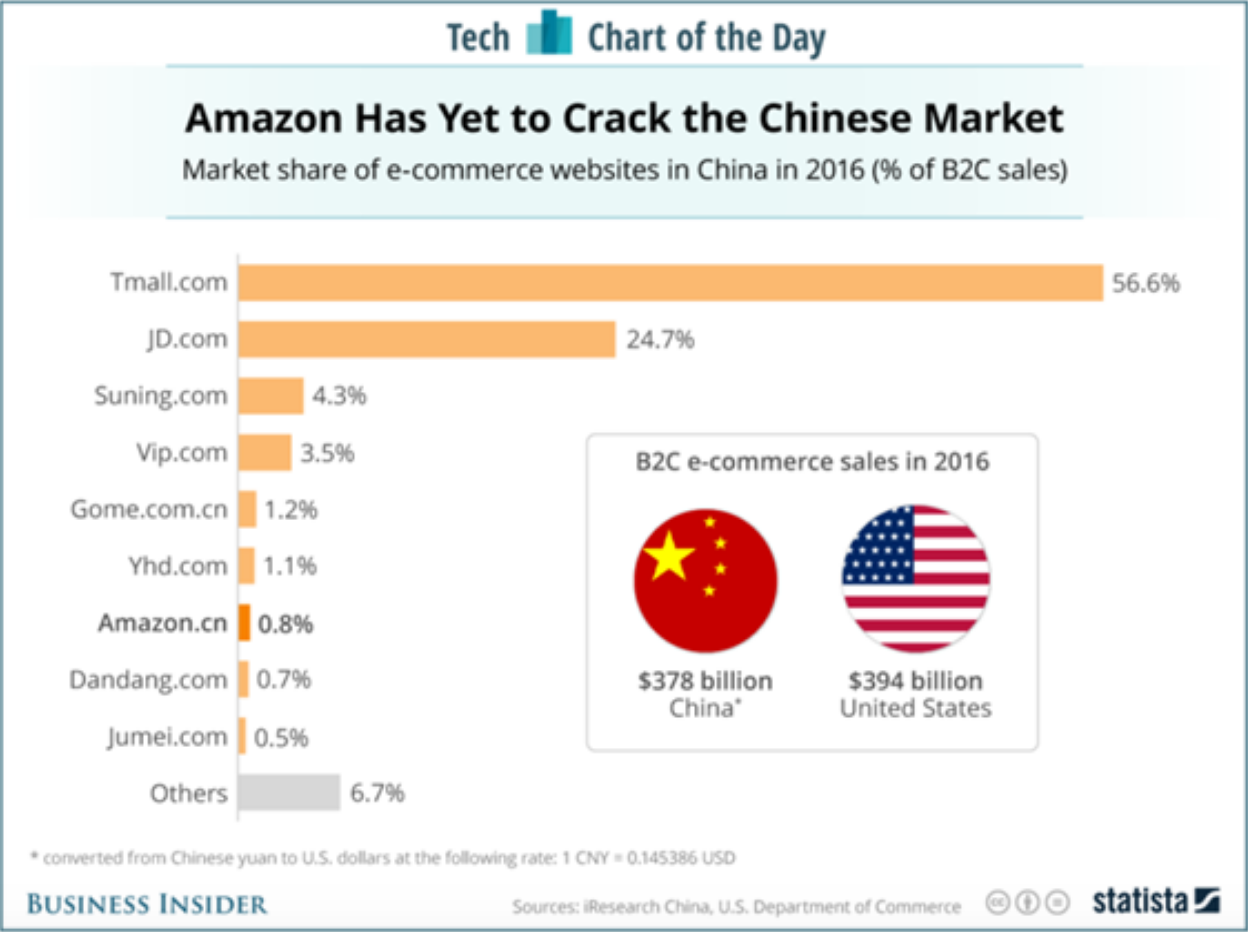

In terms of pure e-commerce capability, IMHO – the Chinese sellers are simply the best. China has the highest e-commerce sales in the world – 5x larger than the US in 2020 – see graphic:

So why would a Chinese company want to hire a foreigner to help with e-commerce, if the Chinese are already the best in the world? Answer: they wouldn’t. And they are fast becoming the largest and most successful sellers on the Amazon platform, killing small American Businesses.

I think Noah Herschman perfectly explained how this trend is changing. Back to top7. Supply and Generally Easier Access to Key-Resources

As we have seen already in this post, Chinese companies – in particular companies located in Shenzhen and around – start often in pole-position because of the access to a lot of resources: fast supply, huge capital to invest from the government and private funds, and I would mention also that it doesn’t hurt to actually be close enough to your supplier, being able to do a quick quality check without having to fly over into another continent. Being close to your supplier not only in terms of space but also in terms of culture, also means having better prices than who is not, for obvious reasons.As for the highly practical culture, speed here is what makes the difference. “The key advantage here is not only cost, but the speed and personal relationships that come from being in the same city on the supply side” continues Zack Franklin. “I would argue it’s an even stronger advantage than being close to your customers! Sellers here are able to take a quick taxi ride to the factory to check on production, but solo sellers located in the west have to hire specialized inspection and QA companies. When your supplier can remember your face or even get dinner with you, your relationship will be much stronger, and you will definitely get priority or better prices.”

“In Shenzhen, [..] (there are) parks only for Chinese Amazon sellers. The government backs them and provides quite a bit of funding. They’re very close to the entire supply chain. What for you is a three week process is for them an afternoon. That’s going to affect your speed to market which is everything in this business. So Chinese Amazon sellers have more support on every level: from the government, from the local community of Amazon sellers, from all these different spaces and business cooperatives. It’s really hard for Americans to compete when they don’t even know that this is going on.” he continues in an interview for Smart China Sourcing.

Noah Herschman adds to this:“The other thing to consider is that there is an unhealthy amount of capital available for Chinese startups. There will be something like $50B venture capital invested in Chinese startups in 2018. I have heard that so far a total of $1T has been invested over the past 10 years by government and private investors in Chinese high tech. While this helps drive innovation to be sure, it has at least one detrimental effect: it prolongs the Darwinian effect of weeding out the weak performers. In other words, many companies are so overcapitalized that they can lose money for an unnatural period. Example: JD.com has lost huge money for 14 years on a row – see just the past 5 years:

But you can see that they are growing faster than their e-commerce competitors:

So investors keep pouring money into JD because they continue to grow market share – so the investors are hoping that one day, they will be in a strong enough position where they can raise prices and/or lower operating costs and turn a profit. When I was at Amazon China in 2008, JD (then called 360Buy), had the same revenue as Amazon.cn. Now they are 30x bigger:

So, the bad news here for the US and EU sellers who have to actually make profit from operations is that the “over-funded” Chinese sellers can afford to lose more money and for a longer period in order to grow their share of the platform, then any of you can possibly handle. In other words, it is going to be harder for Western medium-small sellers (but even for large sellers) to sustain their business on Amazon given the crazy amount of resources available to Chinese sellers.

You can see how challenging it is to source from China when you’re not in China, even for a Chinese national who has been doing business in the States, as Jerry Gan, founder of Valuelink and CEO of AMZ Tracker (interview from GlobalFromAsia TV):

My suggestion: come to see how this world works here, you will be impressed and eventually learn something new. It wouldn’t hurt to open a branch in China or in Hong Kong; it is quite common for any Chinese company that operates on Amazon to open a few branches in the States and in Europe once they start getting serious with this business, as it helps with VAT, warehousing, localized marketing, etc.

Back to top

So, the bad news here for the US and EU sellers who have to actually make profit from operations is that the “over-funded” Chinese sellers can afford to lose more money and for a longer period in order to grow their share of the platform, then any of you can possibly handle. In other words, it is going to be harder for Western medium-small sellers (but even for large sellers) to sustain their business on Amazon given the crazy amount of resources available to Chinese sellers.

You can see how challenging it is to source from China when you’re not in China, even for a Chinese national who has been doing business in the States, as Jerry Gan, founder of Valuelink and CEO of AMZ Tracker (interview from GlobalFromAsia TV):

My suggestion: come to see how this world works here, you will be impressed and eventually learn something new. It wouldn’t hurt to open a branch in China or in Hong Kong; it is quite common for any Chinese company that operates on Amazon to open a few branches in the States and in Europe once they start getting serious with this business, as it helps with VAT, warehousing, localized marketing, etc.

Back to top

8. Black Hat Technology and Practices

Here we are. Black. Hat. Technology. How many times did you hear about that? When we say this 3-word combination do you think of some nerd looking guys playing in the back-end with some strange HTML codes from various seller/buyer accounts, or maybe of a click farm with tons of people making fake orders somewhere in the world? Well, the truth is actually not too far from this kind of imagination. But what is scary, is that black hat can be operated pretty much from anywhere, also just by a single person and in most of the cases it is hard to identify. This easiness within the black hat practices, makes it the most wanted and the most sought-after knowledge of many small Chinese sellers. What is black hat? Black hat is any kind of action that goes against Amazon Seller’s terms and conditions. Now, this could easily get tricky because as we know, Amazon is constantly changing the terms and conditions, so any seller that does not implement their strategy will risk in account suspension for something as easy as to ask for reviews in exchange of discounts – it actually happened to one of the companies that I’ve been working with, this company had more than 300 employees. One thing that won’t make you happier is the increasing presence of Black Hat Technology & Strategy Intensive Workshops, held by e-commerce self-claimed-gurus and sold at a very high price to small groups of Amazon sellers around China. These classes are normally held in one or two days and the price fits in a range between $2000 and $4000 per person. To give you a comparison, the price for a traditional white-hat Amazon marketing class would be around 25%-50% of that.

One of my connections in Shenzhen, who had a service from a company which the main purpose is to sell reviews on Amazon, says that “everybody is doing it; you are stupid if you don’t buy reviews nowadays. But be careful not to get caught by Amazon or they will shut down your account(s)”.

I’ve asked how the fake reviews work and it can be pretty much summarized in this way: the reviews are made by real Amazon.com buyers who actually buy the product, receive the product, and eventually keep the product. The buyers also get a reward (usually around $5) for having bought a product that they will eventually get refunded for! The “fake review agency” pays the buyers the full price of the product + the $5 commission (they normally are in touch with thousands of buyers, most of them are Chinese nationals living in America) and gets paid by the client the same amount + extra commission – generally from 5 to 12 extra dollars. The review is real and verified. There’s no item return.

How to spot a real-fake review? Well, some listings will pass from zero to hero in a matter of days, most of the reviews have a “Chinglish” tone, and there are very few negative reviews. Anything here sounds weird?

One of my friends in Shenzhen has been selling on Amazon for a lot of years, and being an American Born Chinese, he fits perfectly into both the Western and the Chinese worlds – like many others in China. The position (and his amazing Chinese skills) gave him an incredible knowledge of the black hat practices and methods. He wants to keep his name secret for now, but you can find him on WeChat with the user ID “professorofamazon”:

What is black hat? Black hat is any kind of action that goes against Amazon Seller’s terms and conditions. Now, this could easily get tricky because as we know, Amazon is constantly changing the terms and conditions, so any seller that does not implement their strategy will risk in account suspension for something as easy as to ask for reviews in exchange of discounts – it actually happened to one of the companies that I’ve been working with, this company had more than 300 employees. One thing that won’t make you happier is the increasing presence of Black Hat Technology & Strategy Intensive Workshops, held by e-commerce self-claimed-gurus and sold at a very high price to small groups of Amazon sellers around China. These classes are normally held in one or two days and the price fits in a range between $2000 and $4000 per person. To give you a comparison, the price for a traditional white-hat Amazon marketing class would be around 25%-50% of that.

One of my connections in Shenzhen, who had a service from a company which the main purpose is to sell reviews on Amazon, says that “everybody is doing it; you are stupid if you don’t buy reviews nowadays. But be careful not to get caught by Amazon or they will shut down your account(s)”.

I’ve asked how the fake reviews work and it can be pretty much summarized in this way: the reviews are made by real Amazon.com buyers who actually buy the product, receive the product, and eventually keep the product. The buyers also get a reward (usually around $5) for having bought a product that they will eventually get refunded for! The “fake review agency” pays the buyers the full price of the product + the $5 commission (they normally are in touch with thousands of buyers, most of them are Chinese nationals living in America) and gets paid by the client the same amount + extra commission – generally from 5 to 12 extra dollars. The review is real and verified. There’s no item return.

How to spot a real-fake review? Well, some listings will pass from zero to hero in a matter of days, most of the reviews have a “Chinglish” tone, and there are very few negative reviews. Anything here sounds weird?

One of my friends in Shenzhen has been selling on Amazon for a lot of years, and being an American Born Chinese, he fits perfectly into both the Western and the Chinese worlds – like many others in China. The position (and his amazing Chinese skills) gave him an incredible knowledge of the black hat practices and methods. He wants to keep his name secret for now, but you can find him on WeChat with the user ID “professorofamazon”:

“One of the most pronounced Black Hat methods of Chinese seller in use right now is SD (Shua Dan) also known as brushing. When a customer purchases on a site like Amazon/eBay or Walmart, a few months or weeks later they start to receive small envelopes addressed to them. They contain junket items they never ordered, worth mere pennies. The Chinese seller has completed what people in the industry calls brushing “fake purchase” using someone else information. He builds his sales and can even leave his own review if set up properly. This is illegal to do in China but there is very little recourse and risk when they apply these tactics overseas. This is mostly done to give more prominence to high-volume sellers with good track records but anyone can benefit from it.

This work is not for the faint of heart. Lots of work, maintenance and patience goes into setting up a successful (and undetectable) brushing scheme. For starters, having a stable of buyer accounts with vastly different ages, profiles (everything from shipping address, payment methods, IP addresses and buyer buying habits), and operational behavior is daunting for the average player. A lack of doing so makes you stick out easily to Amazon. Even harder is sustainability, this type of work takes dedication and patience. Once again, you can’t go into this fast and hard. Slow and steady always wins the race. Most sellers don’t have the patience to run this successfully. They want their 50 new reviews now! Or by the end of the week!

For these types of devious sellers and competitors, the question being how effective or long lasting are the expected results. Or otherwise stated, what are the desired results: to tie up a customers’ inventory? suspend individual competitors listings? keeping the competitor seller occupied with bad reviews? Get the seller kicked off of Amazon? Up-vote or Down-vote reviews or feedback that helps them or hurts the competition?

Brushing is just the tip of the iceberg, this is just part of seller review fraud. Other undesirable methods include: Review hijacking, Manipulating FBA ratings (clicks, wish lists, etc…), Copyright Claim Fraud, Tricks for winning the buy box (some legit others blackhat), ASIN Piggybacking, PPC click fraud, Custom URL queries, Vendor powered Coupons, and leaving negative feedback/reviews from fake purchases on your competitors listings.”

We will talk more about black hat strategies in China, I’ll probably write one article only about this practices. But for now I want to analyze deeply this matter, talking about the culture and how it affects the use of such practices: could we argue that Western companies have a more “ethic” way of working when it comes to fair competition in a free market compared to the Chinese companies?“What is respected in the West – which is hard work and playing by the rules – is not respected as much here in China. There are just too many people and too much competition” Says Noah Herschman. “The guys who are most revered are the ones who can find the shortcuts. There is very little patience in China. They see their friends and neighbors getting rich and they want to get rich as well. Many of the most successful sellers are able to find a better way to get things done by bending the rules a bit – almost never are they outright breaking policy, but they are excellent at playing within the grey areas.“

“It is not as much an ethics thing as a culture thing.” continues Noah, who has written a series of Linkedin articles on the same topic: “You have to understand why Chinese people behave the way they do. In summary: imagine if you grew up in a country of 1.3 Billion people – if you just play by the rules, you’d get nowhere. There is a Chinese phrase called Zou Jie Jing (走捷径) – which means to take the shortcut. In general, people are admired, not just for their hard work (in China everyone works hard); but their ability to work SMART – and working smart often means finding the road yet untaken. And as long as it doesn’t hurt anyone, it is OK to be creative/innovative (which can also mean not playing exactly by the rules).”

I know a number of Chinese sellers who were taking all kinds of Jie Jings, always telling themselves that they were too smart to get caught and could always stay one step ahead of the “Amazon police”. The faulty logic here is them assuming that these Amazon Police are actual human beings. They’re not of course – they are Machine Learning Algorithms. So even if it is true that Chinese people are smarter than everyone else – you can’t tell me that ANY human is smarter than an algorithm – it simply isn’t true. And this goes double for an ML Algorithm – because they learn from their mistakes; hence you can really use the phrase: fool me once shame on you; fool me twice shame on me. These algorithms rarely get fooled by the same Jie Jing twice.

One more thing that needs to be clarified here: generally it would be the less experienced sellers to make a heavy use black hat tactics, and they would make sure to operate the business from various accounts so that in case one gets suspended, they can sell the same products from a secondary account. Growing their experience and resources (together with the main account value and with the company’s organization), the black hat tricks will be less and less of use. Short answer: the big sellers as Anker, Sunvalley, Aukey etc., are not making use of black hat and shortcuts simply because they don’t need it or because the benefit of a little more sales is much smaller than the potential risk of having the main account shut down compromising the whole business built in years and years.

9. “Creative” Product Launch Strategies

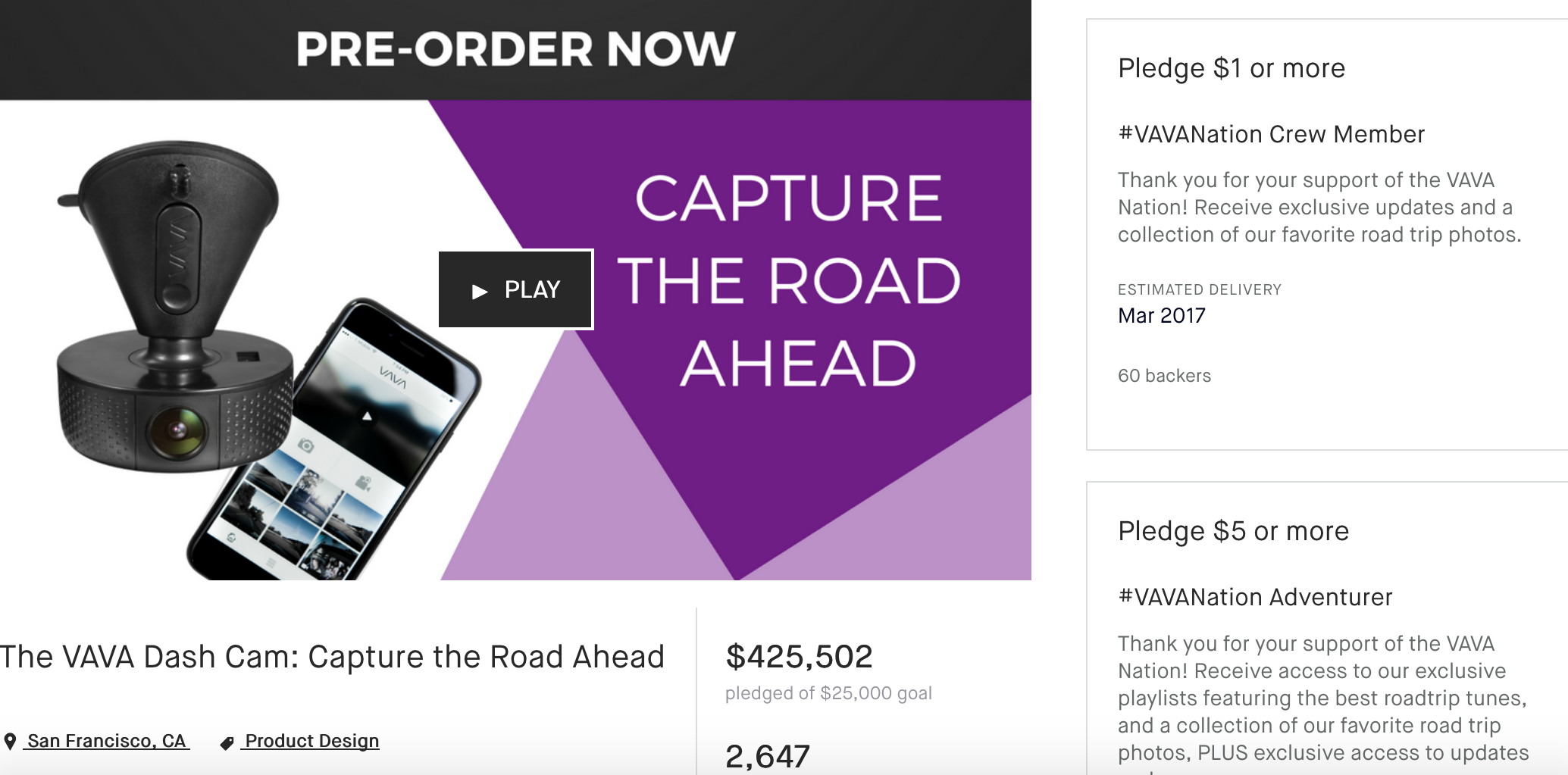

During the product launch phase, the prices of any listings on Amazon are always marked considerably high and then slashed to their actual sales price. This is done to give the illusion that the customer is getting a great product at a massive reduction. Of course, this is not the case. When I was at Sunvalley we worked on a Kickstarter campaign for the VAVA VOOM Bluetooth Speaker. The campaign didn’t go as expected, as there was no planned reason to actually use Kickstarter to launch the product, however regardless of whether the first project got funded or not, the speaker would still appear on the market and make money later on. It appears that Kickstarter and crowdfunding campaigns are becoming a viable way for Chinese e-commerce companies to launch a brand (or even re-brand an existing name) or a new entire product line. After all, a company can leverage the attention a Kickstarter campaign, get to reach a new audience and tap into the media, and even get crowd-funded for doing that! Sunvalley had later on a massive Kickstarter success with their VAVA Car Dash Camera, as did Oceanwings/Anker with their Zolo brand’s Liberty+ wireless headphones. At least in the case of Liberty+, the product isn’t particularly original. Sunvalley’s VAVA brand has a pair of wireless earphones that also come in their own charging case just like the Liberty. Of course it’s not the exact same as the Liberty, but the basic design and function is the same.

So why would a company launch on a crowdfunding platform the exact same project that their competitor has launched a few days or weeks before?

The very idea of copying something that was already there before seems to go against the whole crowd-funding spirit that should encourage innovation and original projects. Well, the answer is: not every potential customer has seen the competitor’s campaign, and it actually is true. Another reason is: the crowdfunding success is largely based on the community, one brand might have a better or not success than its rival in launching the same product depending on how well they do with their community or on how long they’ve been in the market (how recognized they are). Plus, does Kickstarter and other crowdfunding platforms really care?

This is a far different approach from the Western way: “copying” a project is nothing to be ashamed of in China.

We should ask ourselves one thing. Both VAVA and Zolo Liberty+ belong to larger companies, so do they really need to be crowdfunded to be brought to life? Probably not. However, as a strategy to launch a new brand or product line, it’s an excellent idea. Expect more Chinese eCommerce brands turning to Western crowd-funding platforms.

Back to top

Sunvalley had later on a massive Kickstarter success with their VAVA Car Dash Camera, as did Oceanwings/Anker with their Zolo brand’s Liberty+ wireless headphones. At least in the case of Liberty+, the product isn’t particularly original. Sunvalley’s VAVA brand has a pair of wireless earphones that also come in their own charging case just like the Liberty. Of course it’s not the exact same as the Liberty, but the basic design and function is the same.

So why would a company launch on a crowdfunding platform the exact same project that their competitor has launched a few days or weeks before?

The very idea of copying something that was already there before seems to go against the whole crowd-funding spirit that should encourage innovation and original projects. Well, the answer is: not every potential customer has seen the competitor’s campaign, and it actually is true. Another reason is: the crowdfunding success is largely based on the community, one brand might have a better or not success than its rival in launching the same product depending on how well they do with their community or on how long they’ve been in the market (how recognized they are). Plus, does Kickstarter and other crowdfunding platforms really care?

This is a far different approach from the Western way: “copying” a project is nothing to be ashamed of in China.

We should ask ourselves one thing. Both VAVA and Zolo Liberty+ belong to larger companies, so do they really need to be crowdfunded to be brought to life? Probably not. However, as a strategy to launch a new brand or product line, it’s an excellent idea. Expect more Chinese eCommerce brands turning to Western crowd-funding platforms.

Back to top

10. Extremely Competitive Culture

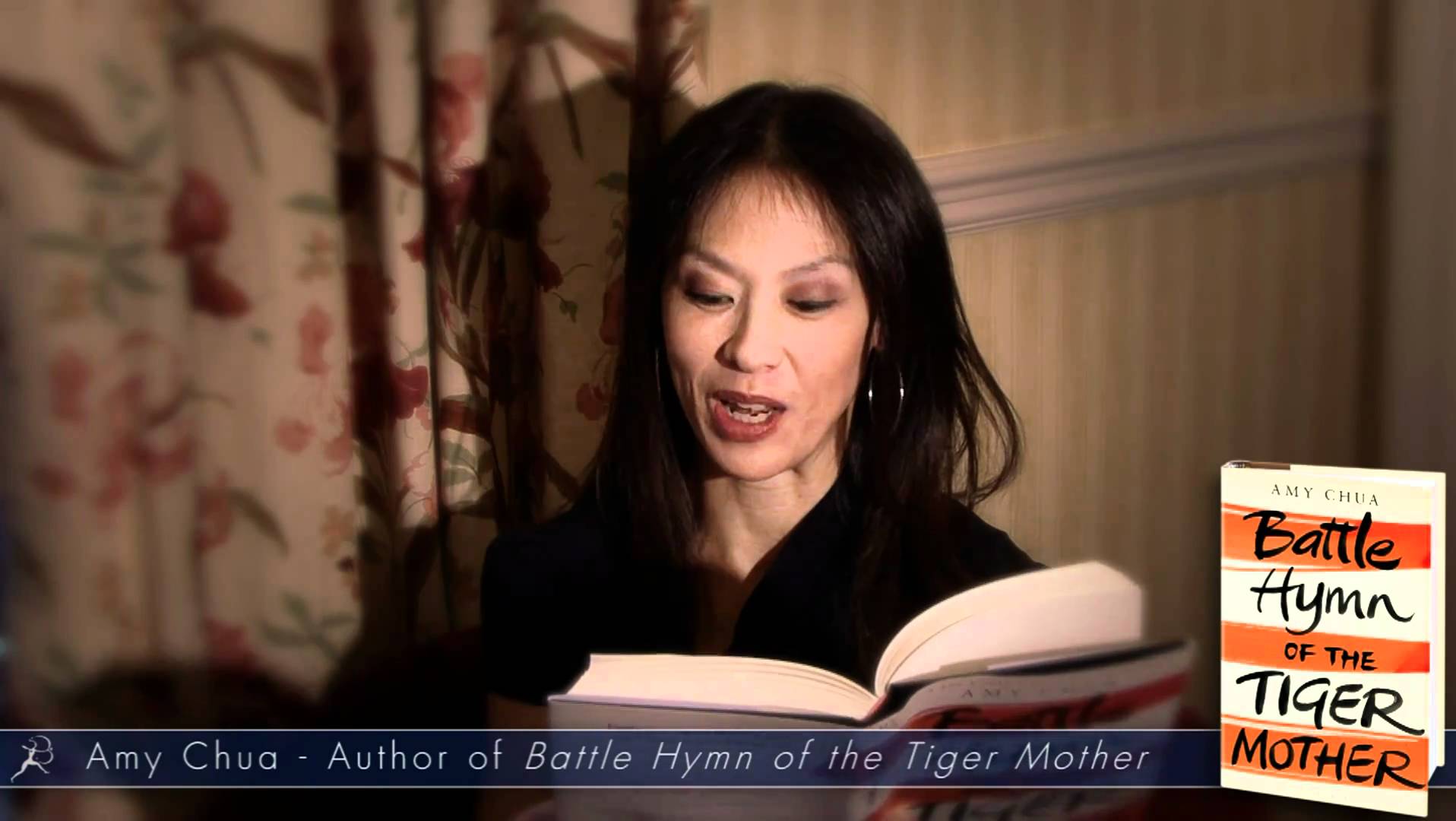

When you live in China, and in cities like Shenzhen, you soon realize that all individuals breathe in an extremely competitive environment and culture. Since the early school times, kids are raised with the idea of having to be top performer as there are too many in the schools. As a foreigner here, I had the impression that everything and everyone is literally replaceable, thus, you have to be extremely competitive to be recognized as valuable. There is a famous book by Amy Chua – suggested to me by a fellow expat in China -, Battle Hymn of the Tiger Mother, a Chinese-American parent, which gives an insider look into this world of raising your child to be the best, in comparison to the Western standards. It is brutal. And worth a read.As a “Tiger mother” herself, she assumed the absolute right to dictate her children’s activities and demand rigorous academic standards of them at all times, ridiculing them if necessary to spur them on to greater efforts. Her children were never allowed to attend a sleepover, have a playdate, watch TV or choose their own extracurricular activities. They were also expected to be top in every subject (except gym and drama) and never get anything other than A-grades – because, Chua explains, Chinese parents believe it is their responsibility to ensure their children’s academic achievement above everything else. – The Guardian.

After school, the motivation isn’t to be a performer. The motivation is to be rich. As obvious as this may be, what motivates Chinese workers and entrepreneurs is just money! Pure and simple. If anything, the competitive workers will leave a company they started a few years or just months ago, to start their own business. Why work hard for someone else when you can work hard for yourself and get rich?

Back to top

After school, the motivation isn’t to be a performer. The motivation is to be rich. As obvious as this may be, what motivates Chinese workers and entrepreneurs is just money! Pure and simple. If anything, the competitive workers will leave a company they started a few years or just months ago, to start their own business. Why work hard for someone else when you can work hard for yourself and get rich?

Back to top

11. Constant Self-Improvement and Study

What does the typical week of a European or American account manager at any e-commerce company look like? It would probably look like this: work from 9 am to 6 pm from Monday to Friday, and having the entire weekend off – time to relax. The typical week of a Chinese account manager at any e-commerce company instead, looks pretty much like this: work 9 a to 8 or 9pm from Monday to Friday and very often on Saturdays as well. Yes, it is common to work on a Saturday for most of the companies in China, the maximum working hours by law per week are 44, and it is absolutely legal to ask the employees to work on a weekend. Normally, during the weekend a good account manager would consider attending some workshop sessions for 4 hours up to 2 days straight of intensive training – in this last case it’s like you have no days off from your work on Amazon – often paying a lot of money from their own pockets. This happens because of the very early entrepreneurship mindset among Chinese workers that we have discussed above. The workshops are normally held around the hottest topics/elements that bring the most value to your products rank on Amazon: keyword search, PPC campaigns optimization, listing optimization, how to use Facebook and other social media, how to get more reviews, etc. This kind of training sessions (white hat) are normally paid $30 to $70 per person. The black hat sessions instead can get much more expensive: a 2-day course of black hat can touch a price of around $3.000 per person.

12. Conclusions

What am I trying to show here, despite what is “good” or what is “bad” at the readers eyes, both Chinese and Western, is the very high commitment of the workers in China, who would give almost anything (at least a lot of their time and personal resources) to be successful in what they do – no matter if it means to take shortcuts not allowed by the system. We have listed above a lot of elements, both cultural and practical, that will influence actions and choices of Chinese workers; and as we have seen, there are huge differences when we compare the two working styles of Chinese and Americans/Europeans. I’m not saying that one method is better than the other one: the two different approaches will look towards different strategies and objectives; but we have also figured that the bigger sellers will use a more “Western” approach to the market in order to be successful in the long term. The whole scope of this article is to be informative and to bring out the differences, and I hope it can help many Western sellers to get a better idea of how the Chinese e-commerce/Amazon sellers can be so good at selling in these countries. It would be good to consider also the most recent news, as Trump imposing heavy import tariffs against China. Or will Trump directly go against Amazon? A very recent user on Quora.com says about the potential damage for the Amazon FBA business:Imposing an import tax would be a really dumb move that would change the US & global economy for the worse, for a long time. Globalization can’t be reversed just by the US alone. This move would ultimately turn us into an isolationist state and we’d have far bigger problems than not being able to sell on Amazon profitably.

Well, in my very honest opinion, digital isolation is what Chinese people have been forced into since the protectionist moves against Google, Facebook and other Western web services. This isolation had the multiple effects of protecting from competitors capital investment, creating an internal exclusively-Chinese market to develop only for Chinese companies (and it’s a huge market where always more western companies want to invest every year) and protecting the data from potential misuse of American companies – see what just happened with the scandal of Cambridge Analytica and Facebook. If you are on top of a country with more than 1.3 billion individuals, you wouldn’t like any other country to mess with the personal data of your people. Back to top——

It took me a lot of time to write this article and I am committed to re-edit whenever I will have some new information to add, so feel free to contact me via email at [email protected] if you have anything to say about this topic, or simply leave a comment with your experience and knowledge on the matter. Thanks to everyone who has read this article until the end and special thanks to the people who have spent some of their precious time in replying my questions, including those who have chosen to keep their name withheld. Read the newest research (November 2018) “War is On: How to Fight Unfair Competition on Amazon“

Omar

Well put!

Davide Nicolucci

Thanks Omar!

Darren

Great article and thank you for taking the time to write it!

Davide Nicolucci

Thank you Darren!

Anonymous

Davide – Great article – we’ve been talking about this a lot in our office. However, Sunvalley absolutely participates in blackhat – as does Maxboost – those guys are the worst. Great insight into the Psyche of the Chinese seller and what US sellers are up against!

Davide Nicolucci

Thank you for the comment! I can’t say for Sunvalley but definitely a lot of other sellers are making use of black hat.

Alex

Davide great article and full of insight. Your article confirms what I have been telling myself in the past year, might be time to bow out of some of the categories we once ruled since the number of competitors has increased dramatically (profit also declined) and if what you say is true about the Chinese sellers pretty much having unlimited funds, I think it is much smarter to look at selling products in less competitive categories for as long as possible and keep open to making changes more quickly instead of losing $$ to prove a point to your stubborn self..

All in all great read and I wish you all the best in the future and look forward to more great articles.

Davide Nicolucci

Thank you very much Alex! Your comment is very appreciated, I’ll keep writing more posts like this one.

Isaac Gross

Great article and thank you for taking the time to write it!

Davide Nicolucci

Thanks Isaac!

Roberto

Davide, thanks for the in depth article on Chinese culture and business ethics. This definitely explains a lot in regards to what is happening recently on Amazon. Definitely Chinese sellers have got a competitive advantage on the Amazon marketplace, that you describe well in your post, and it’s difficult to beat them on the same battle field… prices, access to manufacturers, hard working culture, etc. But what about speaking of the great growth hacking strategies that great Western brands have used to leverage their strengths? Chinese are good in many things but not in everything. Amazon is good for fast and dirty money and many brands are short lived there… if you want to build a real brand you need to think outside of Amazon. Build something on your own land, control your customer experience, your prices and build communities of raving fans on social media. A lot of work and definitely not for the short lived Amazon brands. That’s what makes sustainable and defensible your brand… but not for everybody. Again great article but I’d appreciate some new posts in the future on how great Western companies have build sustainable brands leveraging growth hacking techniques that last to the Chinese price wars we see every day on Amazon. Just an example of a young Western company that has done a great job on that side BestSelf.co. Btw, I’ve no affiliation with them. 🙂 Thanks!

Davide Nicolucci

Thanks Roberto, you said a lot of interesting things. Definitely Chinese (as nobody in the world) can’t be great at EVERY thing, but regarding what matters for selling a lot on Amazon, they are doing it right. For sure the approach that prevails gives benefit to the short-term and not to the long-term. We expats in China are always complaining about this. I strongly believe that the time for US/EU sellers is coming back and my team and I will be here to help

J Gross

Thanks David for this great article. For me as a US Amazon seller this has been a eye opener. I am looking forward reading more of your articles.

Davide Nicolucci

Thanks a lot J! I’ll make sure to write more articles on the topic

JM Mariano

I can’t seem to find a way to subscribe to your newsletter/blogs.

Nice blogpost btw. 🙂

Davide Nicolucci

We don’t have one yet, working on it! Thanks for the feedback it is really appreciated!

Dave

Thanks for the detailed article and you packed it with value throughout… I learned a lot and think back to my many trips to China years ago (with fondness, I enjoyed my time there)… The playing field has changed everywhere and it’s good to get a glimpse of what’s going on now there… I’ve bookmarked the page, and I look forward to reading more of your posts… Cheers ? Dave

Davide Nicolucci

Thanks Dave, I’m glad my article is useful to many! Check the blog home page for more articles like this

Baptiste

Thank you so much for that content ?!!

I almost forgot how competitive they can be.

Davide Nicolucci

Never underestimate the power of your competitor!

Jleze

This is like a research paper at university. Good information. The West needs to study this culture because it will be important going forward. Do you speak chinese or believe it will be good for a westerner to learn the language and use persons who know china and the language to help find manufacturers to source products?

Davide Nicolucci

Hi, thanks for the feedback, I don’t speak Chinese to the level of making business with Chinese people using their language, I use English for most of my communication when it comes to talk about work. I speak basic Chinese for daily life/needs when I am in China Mainland. Having a branch in China or Hong Kong would definitely help step up your business, whether you source from China or not. Just getting used to this culture is a big advantage itself.

Dave Collins

Good info, just make sure to go back and spell “Excel” correctly in section #1.

Davide Nicolucci

ooops! you got it, thanks!

Benjamin

Great article, thanks for putting all this together Davide.

cristina

really good article. thank you!!!

Anon

Hi Davide,

I really enjoyed reading this thorough article. Well written and informative.

Keep up the good work!

Davide Nicolucci

Thanks a lot!

manuel

Great article, very informative and clear, thanks for your time and sharing your knowledge, I will follow this blog! I am a small spanish seller on Amazon and this article and general conclusions leads me to see my difficult position in this table board, I am demoralized thanks, hahaha 😉 How do I compete with them? Difficult response!

Davide Nicolucci

I’m going to write a follow up article that will answer exactly this question!

Murray Popik

You sure know what you’re talking about. Everyone is going to soon be visiting your site.

Rick

Some are true, some are simply not.

Nico Jannasch

Hi Davide,

As a small USA-based seller, tied mainly to Amazon FBA, I’m of course a bit worried that my business may be wiped out, hijacked, black-hatted, or copy-catted out of existence.

Do I understand this right? “You cannot remain a ‘small’ Amazon seller.”

You either need to get capital (or reinvest profits) and scale to $10M/year+ in sales, so your company is also big and fast, or you’ll get wiped out by well-capitalized, marketing-savvy, government-backed, highly motivated Chinese competitors.

Is that right?

Davide Nicolucci

Hi Nico,

thanks for the comment, I really appreciate it. Of course if you want to scale your business and compete face-to-face against big Chinese sellers you should aim to become a large seller yourself and embrace the full list of elements that will give you speed, efficiency, low cost, constant product flooding etc.

Otherwise, if you want to stay small my advise is: differentiate as much as you can from your competitors and do things that they can’t do but that will surely make your users appreciate your service and products (small example: hand-written thank you cards, good community management, great customer service, small gifts in the package, etc).

I’m actually collecting info in order to write the follow up article on how to beat the unfair competition on Amazon, and trust me, it’s not an easy job to provide relevant advises to the small sellers, simply because the whole system where Amazon puts itself today, is in favor of big sellers and of big budget spenders. I believe though that things will change.

The other solution: be still on Amazon but keep it as a promotional secondary channel, you could focus your main sales in a less competitive marketplace or on your own e-commerce (Shopify, etc).

Hope this solves the question. Cheers!

Colin

From your experience, What categories and niches are the most competitive ? You gave a lot of examples from the electronics niche, but I would also be interested in learning more about other categories in terms of the presence of Chinese competition.

Great article, thanks !

Please add a subscription option 🙂

Davide Nicolucci

Hi Colin,

well to be honest every category is getting hot on Amazon. Two years ago it was time for electronic maggagers, a few months ago it was yoga mats, now it’s time for sport equipment and a lot of furniture is coming up… The marketplace is just too big to keep track of all the new hot categories, so good luck! Thanks for the feedback I really appreciate it, and we will add a subscription soon!

Tammy

So, let’s reverse this. If an American company is partnered with a Chinese company, and looking for entrepreneurs who want to build a competitive business quickly in China, how does one go about connecting with the individuals? I have such an opportunity running right now. We are in week one, and need quick connections.

Thomas

Hello Davide,

Thanks for this great article.

Eye opener on so many levels.

That’s terrifying and very stimulating at the same time.

To all US and EU sellers, Brace yourselves, and Get ready to bring your A++ game to compete with these people.

Again, thanks for this must read.

Thomas

Davide Nicolucci

Thank you very much Thomas! The feedback by all of you is well appreciated and is what keeps me researching and writing more and more

Ryan

Great article! Thanks for taking the time to write and post it. I’m almost certain that my Chinese competitor sabotages my listing every chance they get and is definitely using black hat tactics.

Paul

THank you so much for this article. It was very well written and insightful. Keep it up.

Davide Nicolucci

Thanks for your feedback Paul! Appreciate your comment

Austin Stadnik

Great read. Thanks for the insight. Currently living in HongKong working with suppliers in China, learning lots from both sides. Find it interesting as well because obviously some Chinese aren’t as accustomed with western Social media. And social media does help leverage quite a bit, gathering emails from campaigns etc. Would like to hear your take on this.

Davide Nicolucci

Thanks for the comment Austin, my suggestion on the follow up article here https://wearegrowthhack.com/2018/11/21/war-is-on-how-to-fight-unfair-competition-on-amazon/ on how to make a better use of Social Media is actually also for Western sellers, the focus of the article is on Branding and if you take a deep look at the top Chinese Brands, they are starting to do it correctly as well.

bull

Eye opener. I got here by researching my Chinese clients. You see, I sell domain names and noticed that most of the domains names offers and sales I have had, that have to do with branding an item comes from Chinese buyers. They are ruthless bargainers but respectuful and quick in closing transactions that sometimes I have no time to think. The more this particular client buys, the more he comes back, he even asks me stuff like “If you had to brand this particular product, what would you call it?” just like that…Its rare a western company would do that. This time he wanted http://www.powerbankx.com. I am sure he wants it for branding some power banks or electronic products within that angle and I cant have him have it quick as there is an obvious value to such a brand name. Turns out he is one of those 3 guys you mentioned! Thanks for your post.

Davide Nicolucci

Thanks for the comment Bull, your feedback is really appreciated!

Console_Harmony

Fast forward to September 2020, does your heavy praise of Chinese sellers on Amazon still stand? Do you still view the unbelievable amount of fake reviews derived from unethical and illegal business practices that you obsequiously refer to as “black hat” as acceptable and “smart” as you stated? The Chinese have been committing full-scale industrial, and as a result, economic espionage and sabotage, do you even know the insurmountable number of American businesses and/or individuals that have become the financial casualties of this sabotage? How about the overwhelming number of dissatisfied American consumers? What happens when one person buys something and it’s junk and they just wasted their money because they either don’t return it or are unable to get a refund? Even if they do, they’ve still wasted part of their day at the least as well as lowered their view on the integrity and reliability of Amazon, this may not seem like much but then it happens three, four, five or maybe 10 times to the same person or group of individuals living in the same household, then multiply that by millions and millions over the years and now it becomes economic sabotage because at this point, most Americans have experienced something like this and when you add all of that energy wasted, all of those days spent, all of the money spent….that puts the entire country behind in all of those areas not to mention all of the wasted time, money and resources that Amazon has spent to combat this fraud and if they’re not combating the fraud then they’re part of it too, which would be even worse. This article, as insightful as it may be, is teetering on the edge of being nothing more than low-key Chinese communist propaganda with the way that you sympathize and praise Chinese sellers engaging in unfair and illegal business practices on Amazon, admire their banning of American e-commerce and social media and play the victim card for them. The fake Amazon review problem has branched out of Amazon, I assume long ago, and is apparent in many other forms such as this article. Chinese sellers have destroyed Amazon’s reputation, that is something that everyone knows and only a fool or a communist agent would deny.

Davide Nicolucci

Hi, thanks for your comment. I think you’ve misinterpreted the sense of this whole article, that is obviously not to praise Chinese sellers or others who makes use of illicit tactics to hurt Amazon sellers, entrepreneurs and ecommerce businesses. Our objective is to denounce these issues and to open the eyes of every seller out there, especially the new ones. I do encourage you to take a look at the follow up article of this one about Unfair Competition on Amazon https://wearegrowthhack.com/2018/11/21/war-is-on-how-to-fight-unfair-competition-on-amazon/ and to read also all of our other blog posts. We are on your side, don’t worry.